Specialized industrial property loans in Denver are reshaping business financing, offering tailored packages for commercial real estate investors and developers. Lenders cater to various project stages, types, and sectors like logistics and manufacturing, providing flexible terms, competitive rates, and personalized services. Understanding these options is key to optimizing industrial projects' success in Denver's dynamic market, allowing businesses to access the capital needed for construction, refinancing, or equipment financing.

“Uncover the power of tailored loan packages, especially in the dynamic market of industrial property loans in Denver. This comprehensive guide explores why these financing solutions are unique to the region and how they benefit borrowers. From understanding key components to building strong relationships with local lenders, we’ll delve into the advantages of customized financing for industrial real estate projects. Discover how successful tailored loan packages can revolutionize your business’s financial landscape.”

- Understanding Tailored Loan Packages: A Comprehensive Guide

- Why Industrial Property Loans in Denver Are Unique

- Key Components of a Successful Tailored Loan Package

- Benefits for Borrowers: Customized Financing Solutions

- Building Relationships: Lenders and the Local Industrial Landscape in Denver

Understanding Tailored Loan Packages: A Comprehensive Guide

Tailored loan packages, designed with specific industries and asset types in mind, are a game-changer for businesses seeking financial support. In the realm of industrial property loans Denver, for instance, lenders offer specialized financing options catering to the unique needs of commercial real estate investors and developers. This comprehensive guide aims to demystify these tailored packages, empowering business owners to make informed decisions regarding their funding requirements.

By focusing on factors like property type, location, and development stage, lenders can craft loans that align perfectly with the specifics of industrial projects in Denver. Whether it’s a new construction loan for a logistics center or a refinance option for an existing warehouse, these tailored packages provide flexible terms, competitive interest rates, and specialized services. Understanding your financing options, especially within niche markets like industrial property in Denver, is crucial for optimizing your project’s success and financial health.

Why Industrial Property Loans in Denver Are Unique

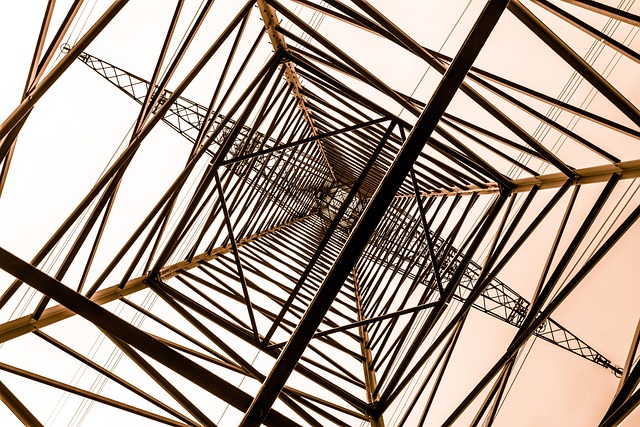

Industrial property loans in Denver stand out due to the city’s unique blend of thriving industry and dynamic market conditions. Denver, a hub for logistics, manufacturing, and technology, experiences high demand for industrial spaces, which drives up competition among lenders and borrowers alike. This competitive landscape translates into more flexible and tailored loan packages for businesses seeking funding for their industrial properties in Denver.

Lenders in Denver recognize the importance of supporting local industries and the economic growth they drive. As a result, they offer specialized services that cater to the specific needs of industrial property owners and operators. Whether it’s financing for new construction, refinancing existing debts, or providing working capital, lenders are more inclined to work closely with borrowers to structure loans that align with their long-term goals. This personalized approach ensures that businesses can access the capital they need to thrive in Denver’s robust industrial market.

Key Components of a Successful Tailored Loan Package

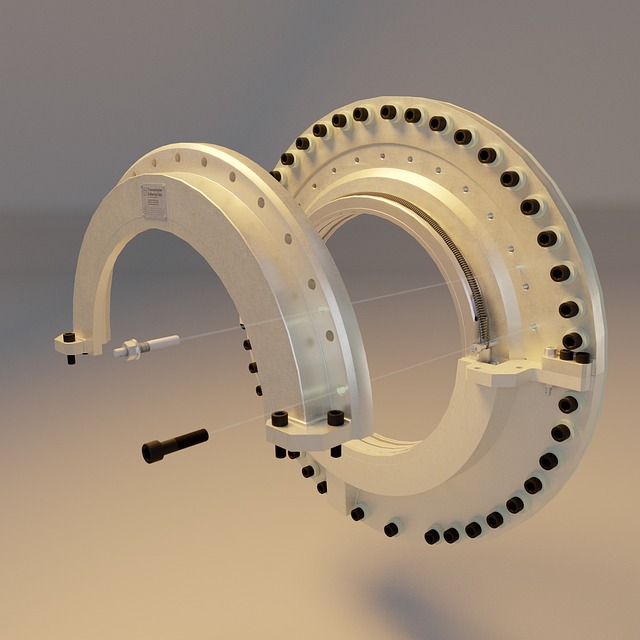

When crafting a successful tailored loan package for industrial property in Denver, several key components come into play. Firstly, understanding the unique needs and goals of the borrower is paramount. This involves assessing the specific requirements of the project, whether it’s for construction, expansion, or equipment financing. Lenders should inquire about the type of industrial property sought (e.g., warehouses, manufacturing facilities) to tailor interest rates and repayment terms accordingly.

Additionally, a comprehensive financial analysis is crucial. Lenders need to review the borrower’s credit history, cash flow statements, and balance sheets to gauge financial health. For industrial property loans in Denver, market trends and local economic conditions must also be considered. This ensures that both parties have a clear understanding of the asset’s value and potential risks, fostering a mutually beneficial agreement.

Benefits for Borrowers: Customized Financing Solutions

When it comes to securing funding for industrial property in Denver, tailored loan packages offer borrowers a multitude of benefits. These customized financing solutions cater specifically to the unique needs and requirements of commercial real estate transactions. Lenders in Denver understand that every industrial property investment is distinct, with varying purchase prices, down payment capacities, and expected return on investments (ROIs). By offering adaptable loan terms, borrowers can find the perfect fit for their financial situation.

For instance, a tailored package might include flexible interest rates, adjustable repayment schedules, or specialized loan products designed for specific property types. This level of customization allows business owners to secure funding that aligns with their strategic goals. Whether it’s financing the acquisition of an industrial warehouse in Denver or refinancing an existing property to unlock capital for expansion plans, these packages ensure borrowers receive competitive terms tailored to their individual circumstances.

Building Relationships: Lenders and the Local Industrial Landscape in Denver

In the dynamic landscape of Denver, building relationships between lenders and local industries is paramount. Lenders who specialize in industrial property loans in Denver understand that each business has unique needs. By fostering strong connections with various sectors—from manufacturing to logistics—lenders can offer tailored financing solutions that align with the city’s evolving industrial tapestry.

This relationship-driven approach allows lenders to navigate the intricate web of Denver’s industrial market, identifying opportunities for growth and investment. Whether it’s a renovation project for an existing facility or funding for a new warehouse, local lenders equipped with knowledge of the area’s real estate dynamics can facilitate transactions that benefit both businesses and the community.

Tailored loan packages, such as industrial property loans in Denver, offer a unique and beneficial approach to financing. By understanding the key components and building strong relationships with local lenders, businesses can access customized solutions that meet their specific needs. This comprehensive guide highlights the advantages of these specialized loans, ensuring a prosperous future for both lenders and borrowers within Denver’s vibrant industrial landscape.