Equipment leasing and specialized industrial property loans in Denver offer businesses strategic financial tools for growth and competitiveness. By understanding different financing options, assessing cash flow needs, and comparing terms, entrepreneurs can leverage these strategies to acquire or upgrade machinery, stay updated with technology, and adapt to market demands, ensuring their industrial properties remain agile and successful in Denver's dynamic marketplace.

“In the dynamic landscape of industrial property ownership, understanding equipment leasing and financing is a strategic move. This comprehensive guide delves into the intricate world of equipment leasing, offering insights tailored for Denver’s thriving industrial sector. From unlocking the benefits of leasing for local property owners to navigating the financing process, we explore how businesses can access essential loans. Additionally, we guide investors through the market, helping them secure optimal equipment leasing options in Denver, fostering growth and innovation.”

- Understanding Equipment Leasing and Financing: A Comprehensive Guide

- Benefits of Equipment Leasing for Industrial Property Owners in Denver

- The Financing Process: Securing Loans for Your Business Needs

- Navigating the Market: Finding the Best Equipment Leasing Options in Denver's Industrial Sector

Understanding Equipment Leasing and Financing: A Comprehensive Guide

Equipment leasing and financing are powerful tools that enable businesses, especially in the dynamic world of industrial property in Denver, to acquire and manage essential machinery and assets. This comprehensive guide aims to demystify these processes, helping entrepreneurs make informed decisions about their operational investments. By understanding the fundamentals, business owners can leverage equipment leasing as a strategic financial tool to drive growth and stay competitive.

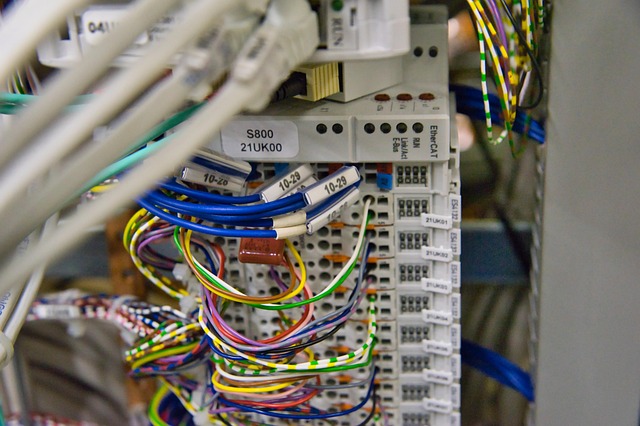

In essence, equipment leasing involves a contractual agreement where a lessor provides an asset (such as industrial machinery or vehicles) for a fixed term, allowing the lessee to use it without the burden of full ownership. Financing options extend this concept, offering various payment structures, including rentals, loans, or purchase agreements tailored to meet different business needs. This flexibility is particularly advantageous in the fast-paced industrial sector, where staying updated with technology and equipment is crucial for Denver-based businesses aiming to thrive in their respective industries.

Benefits of Equipment Leasing for Industrial Property Owners in Denver

For industrial property owners in Denver, equipment leasing offers a strategic financial solution with numerous advantages. Instead of purchasing costly machinery or vehicles outright, leasing allows businesses to access high-quality assets while managing cash flow effectively. This is particularly beneficial in a competitive market where staying agile and adaptable is key for success. By leasing, Denver’s industrial property owners can secure the latest technology without the long-term commitment and significant upfront costs associated with traditional industrial property loans.

Moreover, equipment leasing provides flexibility to scale operations up or down based on changing business needs. Leasing agreements often include options to upgrade to newer models or even return equipment when no longer required, ensuring that businesses always have access to state-of-the-art machinery. This agility not only helps in managing operational costs but also supports the competitive edge of industrial property owners in the vibrant Denver market.

The Financing Process: Securing Loans for Your Business Needs

When it comes to funding your business’s equipment needs, one of the most common and accessible methods is through leasing and financing options. This process involves securing a loan specifically tailored to acquire the industrial property or equipment required for operations. In Denver, where the commercial real estate market is vibrant, businesses can tap into various lenders offering specialized industrial property loans. These loans cater to different sectors, from manufacturing to logistics, ensuring that local enterprises have the necessary capital to invest in their growth and expansion.

The financing process typically begins with a comprehensive assessment of your business’s financial health and the specific equipment or property you wish to acquire. Lenders will evaluate factors such as creditworthiness, cash flow, and the potential return on investment. Once approved, businesses can choose from various loan structures, including traditional bank loans, lease-to-own agreements, or even government-backed financing programs. Each option presents unique advantages, allowing businesses to select the most suitable path for their short-term and long-term financial goals, especially in a competitive market like Denver’s.

Navigating the Market: Finding the Best Equipment Leasing Options in Denver's Industrial Sector

In Denver’s vibrant industrial sector, navigating equipment leasing options is crucial for businesses seeking to acquire machinery and tools efficiently. The market offers a plethora of choices, from traditional banks to specialized leasing companies, each with unique terms and conditions. Businesses should start by evaluating their financial needs and understanding the types of equipment required for their operations. An industrial property loan in Denver can be a game-changer, providing access to funds tailored to purchase or upgrade essential machinery.

When exploring options, consider factors like interest rates, lease terms, and maintenance responsibilities. It’s beneficial to consult with financial advisors who specialize in industrial leasing to ensure the best fit for individual business requirements. With careful consideration and the right financing strategy, Denver’s industrial businesses can thrive by securing the necessary equipment without compromising cash flow.

Equipment leasing and financing are powerful tools for industrial property owners in Denver, offering numerous benefits tailored to their unique business needs. By understanding the various leasing options available on the market, owners can secure competitive rates and flexible terms, enhancing their operational efficiency and financial stability. Whether seeking a short-term solution or long-term investment, navigating the Denver industrial sector’s equipment financing landscape provides access to capital, enabling businesses to thrive in today’s dynamic economic environment. For those exploring industrial property loans in Denver, leveraging leasing as a strategic tool can be a game-changer, fostering growth and ensuring a robust future.